Canadian and US Income Funds That Really Deliver

Looking for a reliable way to generate income from your investments? Think of these two funds as your dependable money-making machines - one for our American friends (SPYI) and one for our Canadian neighbors (HYLD.TO). Let’s break them down in plain English!

The American Option: NEOS S&P High Income ETF (SPYI)

Think of SPYI as a basket that holds pieces of America’s biggest companies (the S&P 500) while using a clever option strategy to generate extra income - kind of like renting out your stocks for additional cash. Here’s what makes it special:

- Started in August 2022 and has already grown to an impressive $2 billion in size (people clearly love it!)

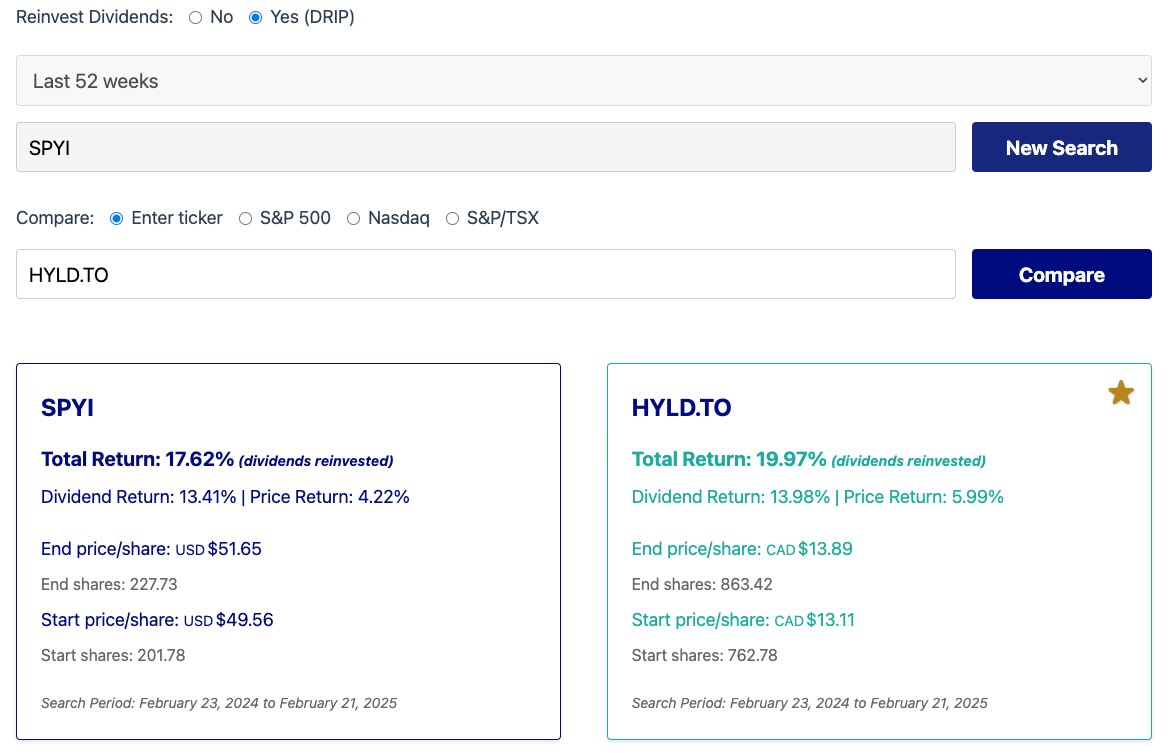

- Delivers a mouth-watering 13% dividend yield, plus a 5% boost from price growth, giving investors an 18% total return over the last year

- Spreads your money across various companies and industries (so you’re not putting all your eggs in one basket)

- Pays you monthly (who doesn’t love regular pay-checks?)

- Keeps drama to a minimum with lower volatility (less roller coaster rides with your money)

and on the Canuck side of the ledger…

The Canadian Contender: Hamilton Enhanced U.S. Covered Call ETF (HYLD.TO)

HYLD.TO takes a slightly different approach - it’s like a fund of funds with a turbo boost. Here’s the scoop:

- Launched in early 2022 and has attracted $800 million from savvy Canadian investors

- Uses 25% leverage (think of it as a power-up in a video game) to boost returns

- Achieved an impressive 20% total return last year

- Also pays a generous 13%+ yield

- Focuses on about 20% of the S&P 500 companies through other funds Hamilton also manages

There is one small wrinkle - HYLD.TO charges a higher fee (2.4% versus SPYI’s more modest 0.69%). But here’s the good news: what really matters is what you take home, and HYLD.TO is still delivering excellent results despite the higher cost.

The Bottom Line

Both funds give you a nice mix of regular income and potential growth - think of it as getting both a steady paycheck (dividends) - and a chance for a raise (price appreciation). SPYI gives you about 75% in dividends and 25% in potential growth, while HYLD.TO has delivered a 70/30 split. This is the sweet spot for many income investors who want to retain a little upside potential.

Canadian investors have a unique advantage here - they can access leveraged funds like HYLD.TO that aren’t available to US investors in this space. It’s like having an extra tool in your investment toolbox!

Whether you choose SPYI or HYLD.TO, both funds are designed to be reliable performers that can help keep your investment income flowing steadily. Just remember, as with any investment, it’s always wise to do your own research and consider how these fit into your overall financial picture. See our full disclaimer in the footer of this page.