Smarter Tools for Your Income Portfolio

Announcing Dependable Income Investing Version 2.0!

We’re thrilled to announce the release of Version 2.0 of the Dependable Income Investing App — our most significant update yet! This release brings powerful new features designed to help you manage your income portfolio more effectively, stay informed about your holdings, and make better investment decisions with less effort.

Whether you’re tracking dividend-paying ETFs, building a retirement income stream, or fine-tuning your portfolio allocations, Version 2.0 delivers the tools you need to invest with confidence.

What’s New in Version 2.0

1. My Funds Tab: Personalized News for Your Holdings

Staying on top of news for your holdings just got dramatically easier. We’ve added a new “My Funds” tab on the News page that automatically shows you news articles relevant to the tickers in your portfolios.

Here’s how it works: The app reads your holdings across all your portfolios, matches news articles by ticker, and dynamically updates as your portfolios change. No more scanning through hundreds of articles or manually searching for news about your funds. Your personalized news feed adapts automatically whenever you add or remove holdings.

This feature is perfect for keeping tabs on dividend announcements, fund updates, distribution changes, and other important news that could impact your income strategy. It’s like having a personal news curator that knows exactly what you own and surfaces the information that matters most to you.

2. Portfolio Templates: Jump-Start Your Planning

Getting started with portfolio planning is now faster and easier thanks to pre-configured portfolio templates in the Plan tool.

Whether you’re building a diversified dividend portfolio, creating a sector-specific income strategy, or exploring different asset allocation approaches, our templates provide a solid starting point. Each template comes with:

- Pre-populated tickers representing proven income-generating funds

- Thoughtfully designed target allocations

- Descriptive information to help you understand the strategy

- Full customization capabilities so you can adapt the template to your specific needs

Simply select a template that aligns with your investment goals, review the holdings, and customize as needed. It’s an excellent way to learn from proven portfolio strategies or quickly set up a new income portfolio without starting from scratch.

Streamlined Plan Page Workflow: We’ve reorganized the Plan page to make the workflow more intuitive. The “Save to Portfolio” option now appears at the completion stage, reducing confusion and helping you focus on planning before committing changes.

Bonus improvement: We’ve also added ticker tooltips throughout the Plan page. Just hover over any ticker symbol to instantly see the full fund or stock name — no more guessing what “XYZ” stands for!

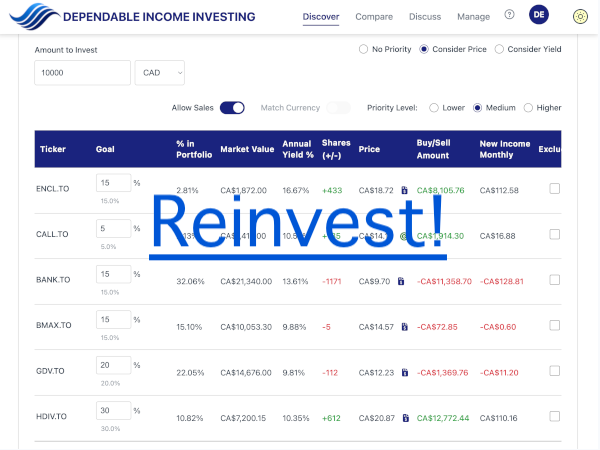

3. Portfolio Reinvest Tool: Smart Cash Deployment

This is the feature many of you have been requesting, and it’s finally here. The new Portfolio Reinvest Tool is a premium feature that helps you intelligently reinvest cash while maintaining your target portfolio allocations.

Managing cash distributions from dividend-paying funds can be tedious. Should you buy more of what you already own? Which holdings are underweighted? What if you want to consider current prices or yields? Our Reinvest Tool eliminates the mental math and spreadsheet gymnastics.

Key features include:

Three Smart Calculation Modes:

- Standard Mode: Suggests optimal purchases and, if allowed, potential sales to rebalance your portfolio

- Proportional Mode: Identifies allocation gaps and suggests purchases to bring your holdings back in line

- Weighted Mode: Factors in current price changes or yields to find the best opportunities for your cash

Interactive Controls:

- Toggle whether to allow sales for rebalancing

- Consider price performance or yield in your calculations

- Match currency preferences for your purchases

- Exclude specific holdings from purchase suggestions

Goal Percentage Management:

- Set and edit target allocations for each holding

- Changes auto-save as you work

- Clear visual display of current vs. target allocations

- Total target percentage shown for tickers in multiple portfolios

Priority Sorting:

- Re-sort suggestions by purchase amount or price decline

- Quickly identify the most impactful purchases

Visual Indicators:

- Highlights holdings currently trading below your cost basis

- Perfect for dollar-cost averaging strategies and buying opportunities

The Reinvest Tool brings sophisticated portfolio management capabilities to individual investors—the kind of functionality that was previously only available through expensive portfolio management software or financial advisors.

4. Enhanced Portfolio Management Features

We’ve added several quality-of-life improvements that make managing your portfolios smoother:

Performance Icon in Holdings Table: Access detailed performance data for any holding directly from your portfolio holdings table. One click takes you to comprehensive charts, dividend history, and return calculations.

Inception Dates Display: Now you can see fund inception dates on both the Compare and Performance pages. This context helps you understand how long a fund has been operating and whether historical performance data represents a mature track record or a newer fund’s early years.

5. Comprehensive Help Documentation

We’ve completely revamped our help system to ensure you can quickly find answers to your questions:

Context-Sensitive Help: Look for the question mark icon on the main menu bar—it’s available from every page in the app. Click it to jump directly to help documentation relevant to the page you’re viewing.

Complete Documentation: We’ve created comprehensive help documentation covering every feature of the app. Access the full guide anytime at: https://dependableincomeinvesting.com/app/help/

Whether you’re a new user getting oriented or an experienced investor exploring advanced features, our help documentation provides clear explanations, practical examples, and step-by-step guidance.

Designed for Income Investors

Every feature in Version 2.0 reflects our commitment to serving the unique needs of income-focused investors. We understand that managing a dividend portfolio involves more than just tracking prices—it requires monitoring distributions, maintaining allocations, staying informed about fund changes, and making smart reinvestment decisions.

Version 2.0 gives you the tools to do all of this efficiently, whether you’re managing a multi-million dollar retirement portfolio or building your first income stream with a few thousand dollars.

Get Started Today

All of these features are available now to Dependable Income Investing users. Premium features like the Portfolio Reinvest Tool, personalized news feed, and portfolio templates are included with premium subscriptions.

If you haven’t explored our platform yet, we invite you to create a free account and experience how Dependable Income Investing can transform the way you manage your income portfolio. Our free tier provides access to powerful comparison tools, performance analysis, and our supportive community of income investors.

For those ready to unlock the full potential of your income investing strategy, premium subscriptions start at just $59 USD for three months or $119 USD per year.

Thank you for being part of the Dependable Income Investing community. We’re excited to see how these new tools help you achieve your income investing goals.

Happy investing!

Ready to experience Version 2.0? Log in to your account or sign up at https://app.dependableincomeinvesting.com